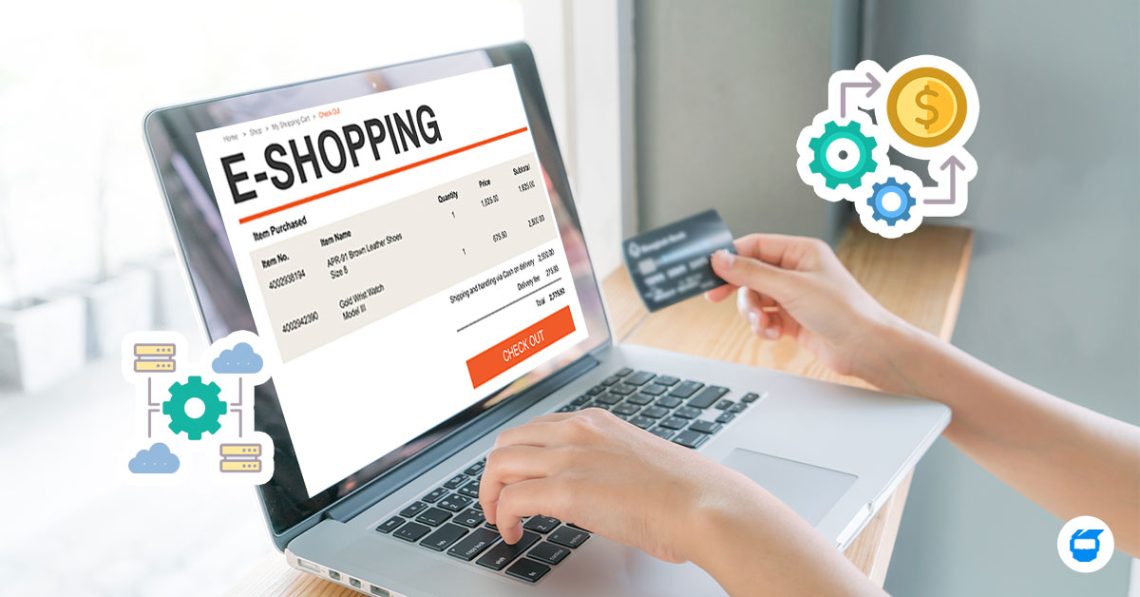

Shopping online has become a way of life for many, especially when the pandemic started. The convenience of browsing, selecting, and purchasing products from the comfort of your own home has revolutionized the way we shop. Behind the scenes, however, there’s a complex process that makes these transactions possible. It’s called payment gateway integration, and it’s the unsung hero of the ecommerce world.

To understand further what payment gateway integration is, why it’s necessary for online businesses, and how it streamlines transactions in the world of ecommerce, keep reading!

Table of Contents

- What is Payment Gateway Integration?

- Why Is Payment Gateway Integration Essential in Ecommerce?

- How Payment Gateway Integration Streamlines Ecommerce Transactions

- How to Choose the Right Payment Gateway for Your Business

What is Payment Gateway Integration?

Imagine you’re shopping online and you’ve just added a fantastic pair of shoes to your cart. Excitement is building as you’re about to make a purchase. You enter your payment information, click “Buy Now,” and within seconds, your order is confirmed. Ever wondered how this magical transformation happens?

Payment gateway integration is the behind-the-scenes wizardry that takes your payment information and securely transmits it from your computer or mobile device to the merchant’s bank. This process makes certain that your payment is processed smoothly, securely, and in real-time. In simpler terms, it’s the bridge that connects the online store to the payment processor, so your money gets to the right place without any hitches.

Why Is Payment Gateway Integration Essential in Ecommerce?

Ecommerce businesses rely heavily on payment gateway integration for several compelling reasons:

1. Security Matters

Online shoppers value their privacy and security. Payment gateway integration employs encryption and various security measures to protect sensitive information such as credit card numbers and personal details. This reassures customers that their transactions are safe and encourages trust in the online shopping experience.

2. Global Reach

Ecommerce transcends borders, allowing businesses to reach customers worldwide. Payment gateway integration supports multiple currencies and payment methods, making it possible for businesses to accept payments from customers across the globe, effortlessly expanding their reach.

3. Customer Convenience

The speed and simplicity of payment gateway integration make the buying process effortless for customers. No one wants to wrestle with a clunky, time-consuming payment system when making a purchase. So this is handy as it ensures that transactions are quick and hassle-free, leading to higher customer satisfaction and more sales.

4. Real-Time Processing

In ecommerce, time is of the essence. Payment gateway integration enables real-time transaction processing, meaning the merchant can receive payment authorization within seconds. This reduces the risk of over-ordering, and it allows the customer to receive instant confirmation of their purchase.

5. Payment Options Galore

Customers have different preferences when it comes to payment methods. Some like credit cards, others prefer digital wallets, and some may even want to pay through alternative methods like PayPal. The use of payment gateway integration provides flexibility by accommodating various payment options, making it easier to cater to a diverse customer base.

How Payment Gateway Integration Streamlines Ecommerce Transactions

Now that we understand why payment gateway integration is crucial, let’s delve into how it streamlines ecommerce transactions.

1. Simplifies the Checkout Process

Picture this: you’ve filled your virtual cart with goodies, and you’re ready to check out. The last thing you want is a complicated, drawn-out payment process. Payment gateway integration simplifies the checkout process by securely collecting and transmitting your payment information, making it a breeze for customers to complete their purchases quickly and efficiently.

2. Reduces Cart Abandonment

One of the biggest challenges in ecommerce is cart abandonment. Many customers add items to their cart but never complete the purchase. A clunky or lengthy payment process is a common culprit. Payment gateway integration helps reduce cart abandonment rates by ensuring a smooth and hassle-free payment experience, encouraging customers to see their purchases through to the end.

3. Minimizes Fraud Risks

In the online world, fraud is a constant concern. The good thing is that payment gateway integration includes robust fraud detection and prevention measures. These tools analyze transactions in real-time, flagging any suspicious activity and helping protect both the customer and the merchant from fraudulent transactions.

4. Enhances Customer Trust

Trust is the cornerstone of ecommerce success. When customers see that their payment information is handled securely and professionally, they’re more likely to trust the online store. Payment gateway integration fosters trust by providing a secure and reliable payment process, ultimately improving the store’s reputation and credibility.

5. Simplifies Reporting and Reconciliation

Behind the scenes, payment gateway integration also simplifies the life of online merchants. It provides detailed transaction reports and streamlined reconciliation, making it easier for businesses to manage their finances and track revenue accurately.

How to Choose the Right Payment Gateway for Your Business

Selecting the right payment gateway for your ecommerce business is a crucial decision. Different gateways offer various features, pricing structures, and levels of customer support. Here are some factors to consider when making your choice:

Related: 7 Top E-Commerce or Digital Payment Gateways in the Philippines

1. Security

Security should always be a top priority. Look for a payment gateway with strong encryption and comprehensive security features to protect your customers’ sensitive data.

2. Compatibility

Ensure that the payment gateway you choose is compatible with your ecommerce platform. Popular platforms like Shopify, WooCommerce, and Magento have specific gateways they work best with.

Related: Shopify Philippines: What You Need to Know

3. Payment Options

Consider the payment methods that your target customers are likely to use. The more options you offer, the better the chance of satisfying your diverse customer base.

4. Fees and Costs

Different payment gateways come with varying fee structures. Pay attention to setup fees, transaction fees, and any additional charges that may apply to your business.

5. Support and Customer Service

Having reliable customer support can be a lifesaver when you encounter issues or need assistance with your payment gateway. Choose a provider known for its responsive support team.

Looking for a trusted Ecommerce Website Developer in the Philippines? Contact us today, and we’ll be glad to help you!

Shopify Website Design

Shopify Website Design  Small Business Marketing

Small Business Marketing